The Global Connected Rail Market was valued at USD 94.89 billion in 2023 and is projected to reach USD 150.39 billion by 2030, growing at a CAGR of 6.8%. The market’s evolution—driven by IoT, AI-driven signaling, passenger experience upgrades, and predictive maintenance—marks a new era in rail mobility and infrastructure optimization.

This press release details market definition, growth drivers, segmentation, regional highlights (USA, Germany), leading players, and strategic outlook.

1. Market Estimation & Definition

Connected rail refers to integrated rail systems that deploy advanced digital technologies—such as IoT sensors, real-time data analytics, cloud computing, AI, GPS, and wireless connectivity—to enhance operations, safety, passenger services, and asset management.

-

2023 Market Size: USD 94.89 billion

-

Projected 2030 Market Size: USD 150.39 billion

-

Forecast Period: 2024–2030

-

CAGR: 6.8%

This definition highlights the convergence of digital solutions with traditional rail infrastructure, resulting in more responsive, efficient, and intelligent systems that serve both passengers and operators.

2. Market Growth Drivers & Opportunities

🚆 Growth Drivers

-

Surge in Urbanization & Mass Transit Expansion: With expanding urban populations, the demand for efficient mass transit systems with seamless passenger experiences—including digital ticketing, real-time updates, and onboard connectivity—is rising.

-

Safety & Regulatory Demands: Modern safety mandates have led to the deployment of systems like Positive Train Control (PTC) and Communication-Based Train Control (CBTC), reducing collisions and improving train frequency.

-

Government Infrastructure Spending: Public investments in railway modernization—particularly in North America, Europe, and Asia-Pacific—are enabling next-gen connectivity through digital control systems and smarter assets.

-

Technological Convergence: The integration of IoT, AI, big data, and 5G facilitates real-time diagnostics, predictive analytics, and remote system optimization.

🌟 Market Opportunities

-

Predictive Maintenance Expansion: Shifting from reactive to condition-based maintenance using sensors and AI reduces downtime and extends asset life.

-

Passenger-Centric Services: Commuters increasingly expect mobile access to ticketing, infotainment, and dynamic travel updates—all enabled by connected platforms.

-

Freight Digitalization: Smart freight wagons with GPS and telematics are transforming logistics, boosting asset tracking, load efficiency, and delivery accuracy.

-

Emerging-Market Railway Modernization: Countries in Asia-Pacific, Latin America, and Africa are upgrading outdated networks with connected rolling stock and digital control systems, presenting robust growth potential.

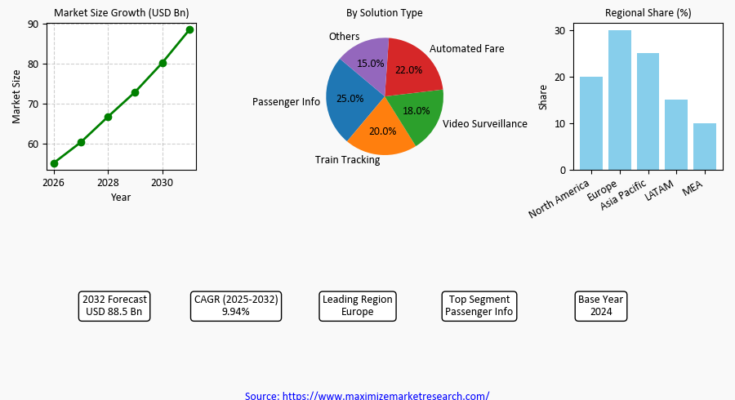

3. Segmentation Analysis

The connected rail market is segmented into three key categories:

➤ By Service:

-

Passenger Mobility & Services

-

Passenger Information Systems

-

Train Tracking & Monitoring

-

Automated Fare Collection

-

IP Video Surveillance

-

Predictive Maintenance

➤ By Rolling Stock:

-

Diesel Locomotives

-

Electric Locomotives

-

Diesel/Electric Multiple Units (DMU/EMU)

-

Light Rail & Trams

-

Metro/Subway Systems

-

Passenger Coaches

-

Freight Wagons

➤ By Safety & Signaling:

-

Positive Train Control (PTC)

-

Communication-Based Train Control (CBTC)

-

Automated/Integrated Train Control Systems

Among these, electric locomotives and metro/subway systems are rapidly adopting connected solutions due to their integration in urban smart city projects. Predictive maintenance and passenger services are particularly fast-growing service segments.

Country-Level Analysis

🇺🇸 United States

The U.S. market continues to lead in rail connectivity with major public and private investment in advanced signaling systems and smart rail infrastructure. Positive Train Control (PTC) has been adopted extensively across freight and passenger rail, enhancing safety and efficiency. Urban rail networks in cities like New York, San Francisco, and Chicago are incorporating automated fare collection, real-time route mapping, and wireless access to elevate the passenger experience.

Estimated growth in the U.S. remains strong, supported by infrastructure bills and state-level smart transit initiatives.

🇩🇪 Germany

Germany has positioned itself at the forefront of connected rail transformation in Europe. Rail modernization projects under national and EU sustainability plans include the rollout of smart signaling, predictive maintenance platforms, and digitized passenger information systems. Deutsche Bahn, the country’s largest rail operator, is actively integrating real-time analytics, AI-based traffic control, and fleet monitoring technologies into its rail infrastructure.

Germany’s regulatory environment, coupled with a strong industrial base, makes it one of the most promising markets for connected rail adoption.

5. Commutator (Competitor) Analysis

🏢 Key Players:

-

Siemens Mobility

-

Alstom

-

Bombardier Transportation (now part of Alstom)

-

Stadler Rail

-

Wabtec Corporation

-

Hitachi Rail

-

Kawasaki Heavy Industries

-

Toshiba

-

CRRC

-

General Electric

-

Mitsubishi Electric

🔍 Competitive Landscape:

The connected rail market is defined by intense technological competition, strategic mergers, and growing R&D investments.

-

Siemens Mobility is leading in automation, digital interlocking, and CBTC systems.

-

Alstom, following its acquisition of Bombardier Transportation, offers a broad portfolio of connected signaling and rolling stock solutions.

-

Hitachi and Kawasaki are advancing smart rolling stock with predictive maintenance and fleet analytics capabilities.

-

CRRC and Mitsubishi Electric are expanding their presence globally, offering cost-effective and scalable connected rail technologies.

-

Stadler Rail and Wabtec are focusing on North American and European markets through service contracts and modular system deployments.

Firms are also forming strategic partnerships with IoT and AI companies to develop cloud-based platforms for fleet management and rail control optimization.

Conclusion & Strategic Outlook

The Global Connected Rail Market is on track for sustained expansion. From USD 94.89 billion in 2023 to a projected USD 150.39 billion by 2030, the market reflects growing reliance on digital transformation to future-proof rail systems worldwide.

🚉 Key Takeaways:

-

Digital technologies are transforming rail into a smart mobility backbone.

-

Predictive maintenance and passenger services are priority growth areas.

-

Safety and signaling upgrades are core drivers, especially in dense urban and cross-border rail corridors.

-

Emerging markets present substantial opportunity for expansion and localization.

🔮 Strategic Recommendations:

-

Invest in AI and cloud analytics to stay competitive in real-time monitoring and diagnostics.

-

Prioritize open platforms that integrate with legacy systems and support modular upgrades.

-

Partner with governments and city planners to align with infrastructure investment cycles.

-

Develop data-driven passenger solutions to boost customer satisfaction and ridership.

As rail networks evolve to meet the challenges of the 21st century, connectivity will remain the cornerstone of safer, faster, and more intelligent transit systems.

Media Contact:

Maximize Market Research

📧 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a global market intelligence and advisory firm focused on technology, mobility, infrastructure, and emerging industry verticals. Our data-driven insights and strategic consulting help enterprises navigate market disruption and scale growth effectively.

Browse full Report: https://www.maximizemarketresearch.com/market-report/global-connected-rail-market/3183/