Global Automotive Electronics Sensors Market Size to Reach USD 76.7 Billion by 2030 Driven by Electric Vehicle Adoption, Advanced Safety Features, and Emission Regulations

The global market for automotive electronics sensors is poised for significant expansion, with the market size expected to increase from USD 47.33 billion in 2023 to USD 76.70 billion by 2030, growing at a CAGR of 7.14%. This rapid growth is underpinned by industry-wide transformations in vehicle electrification, autonomous technologies, and intelligent vehicle management systems.

Global Automotive Electronics Sensors Market Estimation & Definition

The automotive electronics sensors market encompasses a range of sensor technologies used in modern vehicles to monitor, measure, and relay information about vehicle systems and the surrounding environment. These sensors convert physical phenomena such as pressure, temperature, motion, and proximity into electronic signals used to control, automate, and optimize vehicular operations.

Key systems that use automotive sensors include:

-

Power-train systems (engine and transmission)

-

Safety and control systems (airbags, ABS, collision detection)

-

Comfort and climate systems (HVAC, seat control)

-

Navigation and infotainment

-

Telematics and advanced driver-assistance systems (ADAS)

The demand for sensors is rapidly growing in both passenger and commercial vehicles, with emerging technologies like EVs, hybrid vehicles, and autonomous driving requiring even more sophisticated sensor applications.

Global Automotive Electronics Sensors Market Growth Drivers & Opportunity

a. Surge in Electric Vehicle Adoption

The shift toward electric and hybrid vehicles is a major catalyst for sensor market growth. These vehicles rely on a higher number of sensors to manage battery performance, electric drive systems, and energy efficiency. Sensors help monitor battery temperature, cell voltage, and powertrain control, enhancing vehicle performance and longevity.

b. Regulatory Pressure for Emissions & Safety Compliance

Governments across the globe are enforcing stricter safety and emission standards. These regulations are compelling manufacturers to integrate technologies like oxygen sensors, temperature sensors, and NOx sensors to ensure compliance. Similarly, safety norms have driven up the integration of collision warning, airbag deployment, lane assistance, and adaptive cruise control systems, all of which are sensor-driven.

c. Technological Advancements in Sensor Capabilities

Innovations in micro-electromechanical systems (MEMS), wireless sensor networks, and AI-integrated sensing have revolutionized the capabilities and cost-efficiency of automotive sensors. New sensors are becoming smaller, more accurate, and more energy-efficient, supporting real-time data transmission and edge computing for advanced vehicle intelligence.

d. Demand for Advanced Driver Assistance Systems (ADAS)

ADAS features such as automatic emergency braking, adaptive cruise control, lane departure warning, and blind-spot detection require a fusion of sensors like radar, LiDAR, ultrasonic, and vision systems. The rising penetration of semi-autonomous vehicles is further amplifying this demand.

e. Rising Consumer Expectations for In-Vehicle Experience

Modern consumers expect smarter, safer, and more comfortable vehicles. Automakers are integrating sensors for seat positioning, automatic climate control, in-cabin monitoring, and infotainment systems to enhance the driving experience. These features are no longer limited to luxury vehicles and are rapidly entering the mid-range segment.

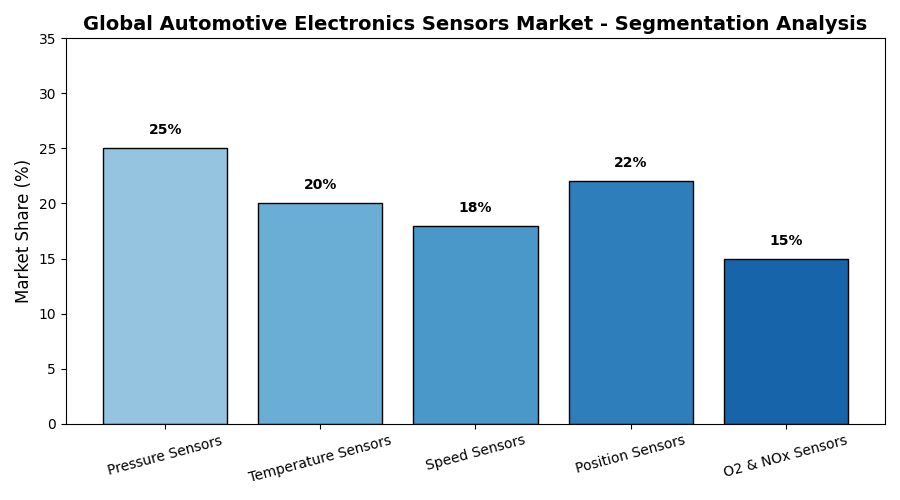

Global Automotive Electronics Sensors Market Segmentation Analysis

By Vehicle System:

-

Airbag System: Incorporates impact and pressure sensors for timely deployment.

-

Brake Control & Traction: Uses wheel speed and pressure sensors to ensure stability.

-

Collision Avoidance & ADAS: Relies on vision, radar, and ultrasonic sensors.

-

Engine Management: Utilizes temperature, oxygen, and fuel-pressure sensors.

-

HVAC System: Employs humidity, air-quality, and temperature sensors.

-

Navigation & Cruise Control: GPS and speed sensors enable adaptive automation.

-

Vehicle Security & Suspension: Uses motion, tilt, and acceleration sensors.

By Vehicle Type:

-

Passenger Vehicles dominate the market due to their high production volumes and growing adoption of sensor-integrated comfort and safety features.

-

Light Commercial Vehicles (LCVs) are witnessing increased integration of telematics and safety sensors.

-

Heavy Commercial Vehicles (HCVs) are increasingly adopting exhaust sensors, pressure monitors, and stability sensors, especially in logistics and fleet operations.

By Application:

-

Powertrain leads the segment with critical functions like emission control, ignition timing, and gear shifting based on real-time sensor data.

-

Chassis & Suspension systems use sensors for stability control and dynamic performance tuning.

-

Safety and Control applications are the fastest-growing, supported by mandatory safety regulations.

-

Climate Control and Comfort Systems continue to expand with rising demand for personalized cabin environments.

By Sales Channel:

-

OEMs (Original Equipment Manufacturers) contribute the lion’s share of sensor integration during manufacturing.

-

Aftermarket channels are growing steadily due to the replacement of worn-out sensors and retrofitting of new features in older vehicles.

By Region:

-

Asia Pacific leads in terms of production and consumption, driven by high vehicle manufacturing in countries like China, Japan, South Korea, and India.

-

North America and Europe follow closely due to high adoption of ADAS, luxury vehicles, and electric mobility.

-

Middle East, Africa, and Latin America are emerging markets with potential growth due to urbanization and infrastructure expansion.

Global Automotive Electronics Sensors Market Country-Level Analysis: USA and Germany

United States:

The U.S. market is driven by the widespread use of advanced safety systems and premium vehicles equipped with cutting-edge sensor technology. Federal regulations and consumer preferences for connected vehicles are pushing OEMs to integrate sensor-heavy systems across segments. The surge in EV adoption, especially in states like California, further accelerates demand for battery management and thermal control sensors.

Germany:

Germany remains the powerhouse of Europe’s automotive sector, home to major OEMs and Tier 1 suppliers. The country emphasizes high-performance, safe, and sustainable mobility solutions. Automotive sensors are integral to German-manufactured vehicles due to their focus on innovation, emissions compliance, and luxury features. Germany’s leadership in autonomous vehicle testing and deployment further supports the high demand for ADAS and sensor technology.

Global Automotive Electronics Sensors Market Commutator Analysis (Key Players & Competitive Landscape)

The automotive electronics sensors market is characterized by intense competition, innovation, and strategic alliances. Key players include:

-

Robert Bosch GmbH – A global leader in sensor manufacturing with strengths in pressure, motion, and environment sensors.

-

DENSO Corporation – Known for its innovation in engine, battery, and climate sensors, especially for hybrid and EV applications.

-

Continental AG – A pioneer in ADAS, LiDAR, and camera-based sensor systems.

-

Autoliv Inc. – Specializes in occupant safety systems including impact and motion sensors.

-

Valeo SA – Active in imaging, ultrasonic, and radar sensors used in parking assistance and environmental monitoring.

-

Sensata Technologies – Known for pressure, force, and thermal sensors.

-

NXP Semiconductors and STMicroelectronics – Key players in supplying integrated sensor chips and controllers.

-

Infineon Technologies – Strong in sensor semiconductors, MEMS, and automotive-grade power devices.

These companies invest heavily in R&D, focusing on miniaturization, wireless integration, and AI-powered sensing solutions. Partnerships between automakers and sensor firms are becoming increasingly strategic to ensure early access to next-gen technologies.

Global Automotive Electronics Sensors Market Conclusion

The Global Automotive Electronics Sensors Market is entering a period of rapid transformation and growth. From enabling electric mobility and regulatory compliance to supporting vehicle intelligence and autonomy, sensors are the nervous system of the modern automobile.

With the market expected to grow from USD 47.33 billion in 2023 to USD 76.70 billion by 2030, stakeholders across the value chain—OEMs, Tier 1 suppliers, semiconductor companies, and tech firms—must collaborate to harness this growth. Investment in innovation, local manufacturing, and digital ecosystem integration will be key differentiators in the decade ahead.

As vehicles become smarter, safer, and more efficient, the role of electronics sensors will not just support functionality—it will define the future of mobility.

Read More: