Enhanced In-Vehicle Experience and Tech-Driven Safety Propel Growth

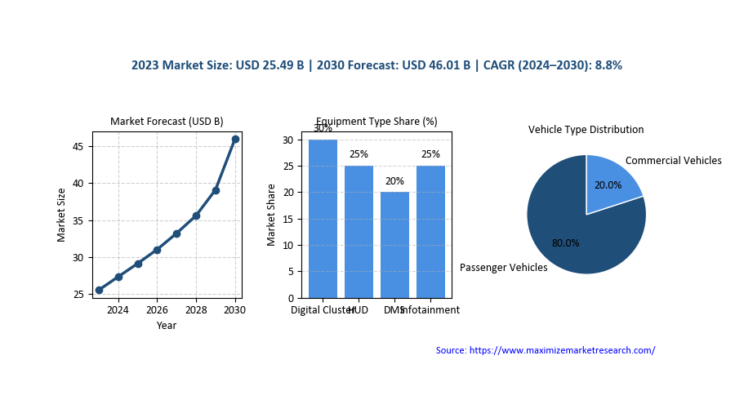

The global Automotive Digital Cockpit Market is projected to surge from USD 25.49 billion in 2023 to USD 46.01 billion by 2030, growing at a robust 8.8% CAGR during the forecast period. This growth is driven by increasing consumer demand for connected, immersive, and safer in-vehicle experiences.

Global Automotive Digital Cockpit Market Estimation & Definition

The automotive digital cockpit integrates advanced driver information, infotainment systems, and safety displays into a unified human-machine interface (HMI). Key components include digital instrument clusters, infotainment units, head-up displays (HUDs), and driver monitoring systems (DMS). These systems enhance driver awareness, enable personalization, and act as vital interfaces for vehicle control, entertainment, and navigation.

As global vehicle architecture shifts towards software-defined platforms, digital cockpits are becoming central to delivering intuitive control and smart connectivity. In 2023, the market stood at USD 25.49 billion, and with rapid adoption across electric and autonomous vehicles, it is set to cross USD 46 billion by 2030.

Global Automotive Digital Cockpit Market Growth Drivers & Opportunities

Key Drivers:

-

Rising Demand for Personalized Driving Experiences

Today’s consumers expect vehicles to offer smartphone-like interfaces, voice assistants, and customized dashboards. This is driving OEMs to develop immersive, intelligent cockpit systems. -

Adoption of Electric and Autonomous Vehicles

With the global shift towards electric mobility and autonomous driving, the role of digital displays, HUDs, and smart control systems has become critical for navigation, energy management, and safety visualization. -

Safety and Regulatory Mandates

Increasing regulations surrounding driver attentiveness and in-vehicle distraction prevention have made features like DMS, alert systems, and HUDs standard in new vehicle designs. -

Technological Advancements and Connectivity

The integration of 5G, IoT, and cloud platforms into vehicles enables over-the-air (OTA) updates, app integration, and real-time diagnostics—expanding the value proposition of digital cockpits.

Global Automotive Digital Cockpit Market Emerging Opportunities:

-

Augmented Reality (AR) Head-Up Displays: The evolution of HUDs into AR-enabled systems offers better situational awareness and navigation support.

-

AI-Powered Interfaces: AI integration enables voice recognition, gesture control, and predictive suggestions based on driver behavior.

-

Over-the-Air (OTA) Platform Integration: OEMs can deliver cockpit software updates and services remotely, reducing downtime and improving customer engagement.

-

Modular & Scalable Platforms: The demand for scalable cockpit modules across vehicle segments presents opportunities for cost-effective manufacturing and streamlined user experiences.

Global Automotive Digital Cockpit Market Segmentation Analysis

By Equipment:

-

Digital Instrument Cluster: Core interface replacing analog dials with customizable digital displays.

-

Head-Up Display (HUD): Displays critical information like speed and navigation directly on the windshield, ensuring driver focus and reducing distraction.

-

Driver Monitoring System (DMS): Cameras and sensors monitor driver attentiveness, reducing fatigue-related incidents.

-

Advanced Head Unit: The central infotainment hub offering media, navigation, and connectivity services.

HUDs are the fastest-growing sub-segment, expected to grow at over 11.7% CAGR, driven by regulatory requirements and consumer interest in AR-enabled driving aids.

By Vehicle Type:

-

Passenger Vehicles: Represent over 80% of market revenue, thanks to growing integration of infotainment and smart dashboard systems.

-

Commercial Vehicles: Increasing demand for fleet management, telematics, and safety solutions is pushing adoption of digital cockpits in buses and trucks.

By Electric Vehicle Type:

-

Battery Electric Vehicles (BEV)

-

Hybrid Electric Vehicles (HEV)

-

Plug-in Hybrid Vehicles (PHEV)

EVs benefit from cockpit platforms that are lightweight, software-driven, and energy-efficient, aligning with the operational characteristics of electric powertrains.

Global Automotive Digital Cockpit Market Country-Level Analysis

United States:

-

The U.S. market is accelerating cockpit technology adoption due to its large EV base and rising integration of Advanced Driver Assistance Systems (ADAS).

-

OEMs are increasingly focused on delivering personalized experiences, combining AI voice assistants, touchscreens, and cloud updates.

-

Collaborations between auto manufacturers and chipmakers are fostering new digital cockpit platforms for North American models.

Germany:

-

Germany remains a global leader in cockpit innovation, with premium brands like BMW, Mercedes-Benz, and Volkswagen driving mass adoption.

-

Regulatory focus on driver safety, such as EU-mandated DMS, is spurring demand for camera-based monitoring systems.

-

The rise of AR-enabled HUDs and infotainment units in luxury vehicles is expanding the digital cockpit segment in Europe’s automotive heartland.

Global Automotive Digital Cockpit Market Commutator Analysis (Digital Cockpit Architecture)

Modern digital cockpits rely on central compute units and embedded system architectures to consolidate processing across infotainment, instrument clusters, and ADAS. Similar to how electrical commutators direct current in a motor, cockpit platforms distribute power and data to various vehicle systems in real time.

Key Considerations:

-

Centralized SoCs (System-on-Chip): Chipsets process vast amounts of vehicle data, powering multiple displays and managing voice/gesture inputs.

-

Thermal Management: With increasing compute power, managing heat output is critical in compact cabin environments.

-

Data Network Integration: Communication over CAN, Ethernet, and wireless protocols requires secure and efficient routing across subsystems.

-

Cybersecurity & Software Integrity: Secure boot processes and encrypted OTA updates are essential to protect user data and cockpit functionality.

Global Automotive Digital Cockpit Market Innovations in Focus:

-

AI Edge Processing: Enables real-time responses for DMS, voice commands, and navigation updates without reliance on cloud latency.

-

Modular Upgrades: Digital cockpits are now being designed to support future updates, much like smartphones—enhancing product longevity and value.

-

Minimalist Design Philosophy: Next-gen cockpits are focusing on screen unification, intuitive layout, and clutter-free UX to appeal to digital-native drivers.

The global Automotive Digital Cockpit Market is undergoing a paradigm shift from traditional dashboard designs to fully integrated digital ecosystems. With an expected valuation of over USD 46 billion by 2030, digital cockpits are no longer optional—they are central to the next generation of vehicles.

Key market forces such as electrification, connected mobility, and safety mandates are pushing both OEMs and Tier-1 suppliers to innovate rapidly. With rising demand for AR interfaces, AI-powered control, and modular computing platforms, cockpit solutions are becoming the battleground for automotive differentiation.

Global Automotive Digital Cockpit Market Strategic Takeaways for Industry Players:

-

Invest in R&D for cockpit systems that combine infotainment, safety, and personalization into a seamless interface.

-

Leverage AI and AR technologies to enhance usability, comfort, and driving performance.

-

Align with global safety standards, especially with the coming wave of DMS regulations in Europe.

-

Foster partnerships across the digital ecosystem—from chipset vendors to cloud providers—to ensure cross-functional integration.

As the boundary between digital devices and driving experience fades, automotive digital cockpits are set to define how drivers interact with their vehicles, their environment, and even each other. Industry leaders who embrace this transformation now will set the standards for the connected cars of tomorrow.

Key Companies Operated In The Report Are:

1. Robert Bosch GmbH

2. Continental AG

3. Denso Corporation

4. Visteon

5. Panasonic

6. Hyundai Mobis

7. Garmin

8. Nippon

9. Faurecia

10. Aptiv

11. Pioneer

12. Magneti Marelli

13. Valeo

14. Clarion

15. Calsonic Kansei Corporation

16. Wayray

17. Preh

18. Desay SV

19. Yazaki

20. Luxoft

Media Contact:

Maximize Market Research Pvt. Ltd.

Pune, India

Email: info@maximizemarketresearch.com

Phone: +91 9607365656