The global push toward decarbonization is rapidly transforming the heavy machinery sector, and electric mining trucks are emerging at the forefront of this industrial revolution. According to latest market insights, the Electric Mining Truck Market Growth is expected to register robust expansion driven by sustainability mandates, cost efficiencies, and technological innovation.

Mirroring how the global breakfast cereal market reached USD 51.76 billion in 2024 (with a 5.2% CAGR), the electric mining truck industry is now surging ahead, with analysts forecasting a CAGR of over 8% between 2025 and 2032, firmly establishing “electric mining truck market growth” as a defining theme for the decade.

Electric Mining Truck Market Growth Estimation & Definition

The Electric Mining Truck Market refers to a segment of off-highway heavy vehicles that use electric or hybrid-electric propulsion systems instead of traditional diesel engines. These vehicles are primarily deployed in large-scale mining operations—including surface and underground mining—for hauling earth, ore, and other heavy materials.

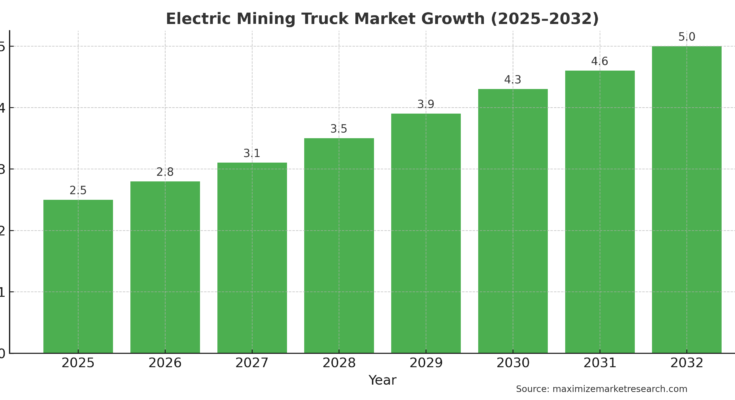

As of 2024, the market size is estimated at USD 2.5 billion, and is projected to reach nearly USD 5 billion by 2032, growing at a CAGR of over 8%. The surge in electrification across mining operations globally underscores the sector’s rapid modernization.

Just as consumers in the breakfast cereal industry sought healthier and more convenient choices, mining companies are now seeking cleaner, cost-effective solutions that align with ESG goals and reduce long-term operating expenses.

Electric Mining Truck Market Growth Drivers & Opportunity

🔋 Key Growth Drivers

-

Environmental Regulations & Carbon Targets

Governments worldwide are introducing stricter emissions standards for industrial vehicles. The mining industry, a known heavy polluter, faces pressure to decarbonize operations rapidly. Electric trucks emit zero tailpipe emissions, making them a priority investment. -

Operating Cost Reduction

Electric trucks are not only more efficient but also cheaper to operate in the long term. Electricity costs are significantly lower than diesel, and electric drivetrains require less maintenance, translating to long-term cost savings. -

Advanced Battery Technologies

Improvements in battery energy density, charging speed, and life cycle are making electric trucks more viable in high-load, high-duration applications such as mining. -

Corporate Sustainability Mandates

Major mining corporations including BHP, Rio Tinto, and Glencore are publicly committing to carbon neutrality, setting aggressive timelines for electrifying their fleets.

Electric Mining Truck Market Growth Opportunities

-

Retrofit and Conversion Demand

Many mining operators prefer converting existing diesel fleets into electric using retrofit kits, offering a lucrative after-sales opportunity for manufacturers. -

Leasing Models & Battery Swaps

To minimize capital costs, leasing electric trucks and batteries on a subscription model is gaining traction, especially in developing markets. -

Emerging Market Expansion

Rapid industrialization in Latin America, Southeast Asia, and Africa presents significant opportunities for first-time adopters of clean mining technologies. -

Collaborative Innovation

Equipment OEMs are teaming up with battery manufacturers and mining firms to co-develop tailor-made electric solutions—a trend similar to food giants collaborating with health startups to develop new cereal formulations.

Electric Mining Truck Market Growth Segmentation Analysis

Based on the structural segmentation of the breakfast cereal report, the Electric Mining Truck Market can be segmented into:

By Propulsion Type

-

Battery Electric Trucks (BEVs): Zero-emission, powered exclusively by battery packs.

-

Hybrid Electric Trucks: Combine electric drive with a diesel backup, ideal for longer ranges.

By Capacity

-

<100 Tons: For small to medium-scale operations.

-

100–300 Tons: Standard capacity for global mining operations.

-

>300 Tons: Used in ultra-large surface mines.

By Application

-

Surface Mining: Most common application, including coal, iron ore, and bauxite.

-

Underground Mining: Low-emission environments where ventilation costs are high.

By Charging System

-

Static Fast Charging

-

Battery Swap Stations

-

Onboard Charging with Solar Backup

By Region

-

North America, Europe, Asia Pacific, South America, Middle East & Africa

Electric Mining Truck Market Growth Country-Level Analysis

🇺🇸 United States

The U.S. market is being driven by federal carbon targets and tax credits for clean technologies. American mining firms are early adopters of autonomous and electric trucks, especially in the iron and copper belt of Arizona and Utah.

🇩🇪 Germany

Germany is spearheading innovation in Europe, with mining equipment manufacturers investing heavily in electrification. State incentives and an ambitious green industry strategy are pushing the use of electric drive in mining and construction fleets.

🇨🇦 Canada

Canada’s mining-rich provinces such as Alberta and Ontario are investing in hybrid-electric and fully electric fleets, supported by grants and zero-interest loans from green innovation funds.

🇨🇳 China

Though not requested, it’s worth noting that China dominates lithium battery production and is rapidly electrifying its mining sector to reduce dependency on fossil fuels.

Electric Mining Truck Market Growth Commutator (Competitor) Analysis

A review of leading market participants highlights a rapidly evolving competitive landscape:

| Player | Focus Area | Recent Development |

|---|---|---|

| Caterpillar | Hybrid mining trucks | Pilot with BHP |

| Komatsu | BEV haul trucks | Introduced 220-ton class EV |

| Liebherr | Modular battery packs | Partnered with ABB |

| Hitachi | Electric drive control | Joint ventures in Australia |

| Epiroc | Underground electric vehicles | Focus on European mines |

Electric Drive Mining Truck Key Players1. Terex Corporation 2. Hitachi, Ltd. 3. OJSC BELAZ 4. XCMG Group 5. BEML Limited 6. Caterpillar Inc. 7. Komatsu Ltd. 8. Kuhn Schweiz AG 9. Voltas Ltd. 10. Epiroc Mining India Limited 11. Volvo 12. BelAZ 13. BEML 14. Voltas 15. Kress 16. Xiangtan Electric Manufacturing.

Startups and Tech Entrants:

Companies like Volta Trucks, First Mode, and Medatech Engineering are introducing retrofitting kits and software-driven energy optimization tools, pushing innovation beyond traditional OEMs.

Battery Providers:

CATL, Panasonic, and Tesla are aggressively pursuing large-format battery markets, making them critical players in electric truck viability.

Infrastructure Developers:

ABB, Siemens, and Schneider Electric are deploying on-site high-voltage charging and microgrid systems at mining locations.

6.Electric Mining Truck Market Growth

The electric mining truck market growth story is no longer a concept but a tangible industrial shift. Fueled by the same global momentum that accelerated healthy and sustainable options in the breakfast cereal market, the mining industry is seeing a similar paradigm shift—from diesel dominance to electric evolution.

The sector’s projected CAGR of over 8% through 2032 underscores widespread acceptance. While regulatory pressure and cost dynamics drive adoption in mature markets like the U.S. and Germany, the next wave of growth will stem from Asia and Latin America.

Companies that invest early in electrification, partnerships, and retrofitting solutions will position themselves as market leaders in this next-generation mining landscape.

Browse More Related Report:

https://researchmaximize.com/electric-drive-mining-truck-market-size/